Unlock the financial support you deserve. Our comprehensive guide helps you navigate Canada's federal and provincial benefit programs.

Get Your Free Guide NowA monthly payment available to most Canadians aged 65 and older, regardless of their employment history.

Learn More (canada.ca)An additional monthly payment for low-income OAS recipients living in Canada.

Learn More (canada.ca)A tax-free monthly payment made to eligible families to help them with the cost of raising children under 18 years of age.

Learn More (CRA)A tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay.

Learn More (CRA)Applying for government benefits can seem complex, but understanding the process makes it straightforward. Most applications require you to meet specific criteria related to income, age, and residency status.

Disclaimer: This information is for general guidance only and does not constitute professional advice. Eligibility criteria and program details can change. Always refer to official government sources for the most accurate and up-to-date information.

Beyond federal support, each Canadian province and territory offers unique benefit programs tailored to the needs of their residents. These can range from housing assistance to child care subsidies and tax credits.

Combines the Ontario energy and property tax credit, the Northern Ontario energy credit, and the Ontario sales tax credit into one payment.

Learn More (ontario.ca)

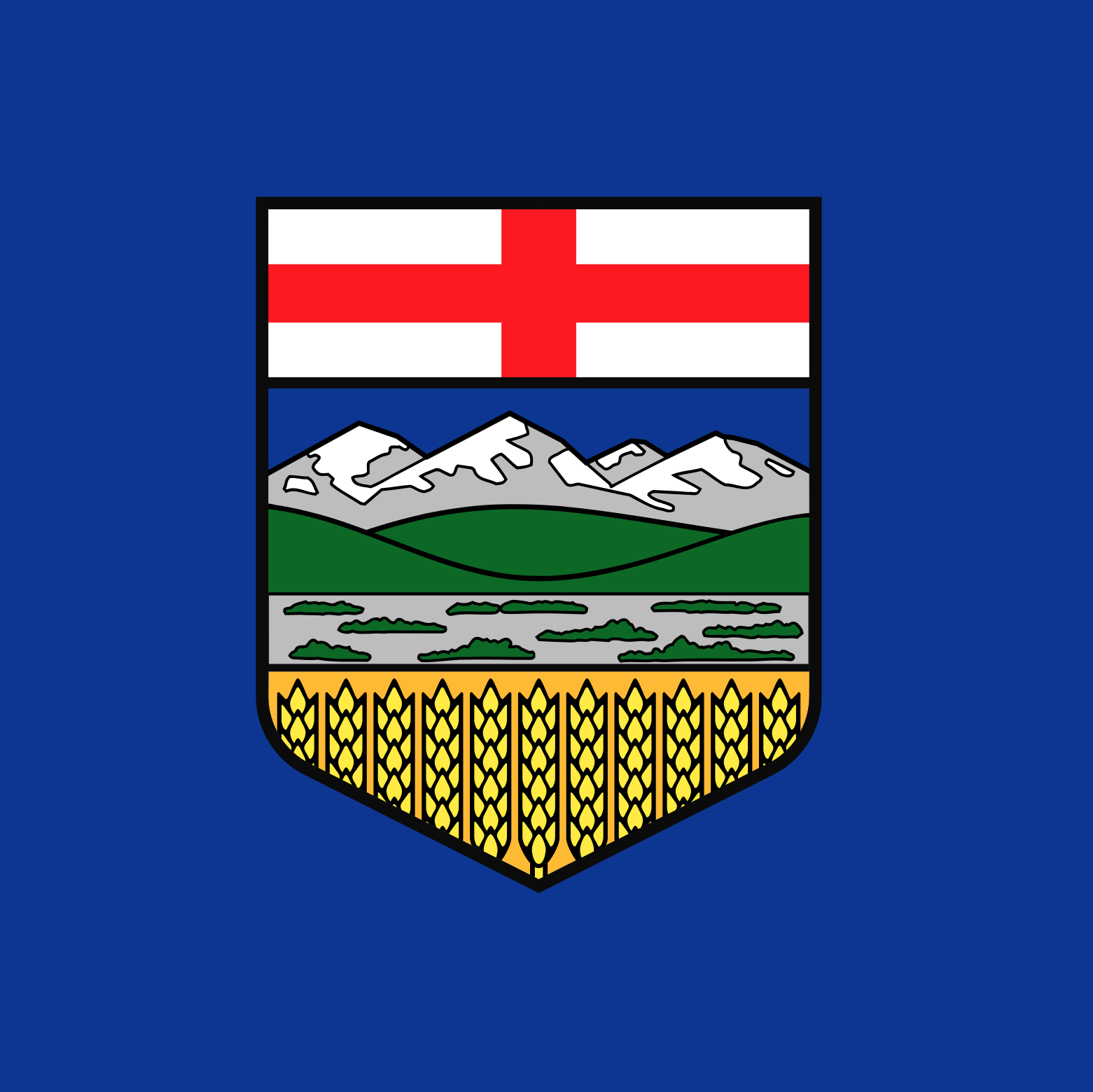

A tax-free payment to eligible families with children under 18 years of age, designed to help with the cost of raising children.

Learn More (alberta.ca)

A refundable tax credit for low-income individuals and families in Quebec, combining components for housing, QST, and individuals living in northern villages.

Learn More (revenuquebec.ca)Disclaimer: This list is not exhaustive. Many other provincial and territorial programs exist. Always check your specific province's official government website for a complete list of available benefits and eligibility criteria.

"This guide was a lifesaver! I had no idea I was eligible for the GST/HST credit until I read through the clear explanations here. The links to official sources made applying so easy."

- Sarah L., Toronto, ON

"Navigating government benefits can be overwhelming. This site simplified everything, especially the provincial programs section. Highly recommend for anyone in Canada seeking financial assistance."

- David P., Vancouver, BC

"As a new immigrant, I was unsure about what benefits I could receive. The 'How to Apply' section was incredibly helpful, guiding me through the process step by step. Thank you!"

- Maria K., Montreal, QC

"I thought applying for OAS would be complicated, but this site provided all the necessary information and direct links. It saved me so much time and confusion."

- Robert M., Calgary, AB

A: Yes, some students may be eligible for certain benefits, though eligibility often depends on factors like age, income, and whether they have dependents. For instance, students with low income may qualify for the GST/HST credit. Provincial programs might also offer specific student aid. Always check the specific program's criteria.

A: For most major federal benefits like OAS, GIS, and CCB, you generally need to be a Canadian citizen, a permanent resident, or a protected person. Some provincial programs may have different residency requirements. It's crucial to check the specific program's eligibility rules regarding immigration status.

A: It depends on the benefit. For example, the Canada Child Benefit (CCB) and the GST/HST Credit are tax-free. However, Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) are generally considered taxable income, though GIS is not subject to income tax withholding. Always consult official CRA guidelines or a tax professional for specific tax implications.

A: Many federal benefits, such as OAS and GIS, are indexed to inflation and are reviewed quarterly (in January, April, July, and October) to reflect changes in the cost of living. Other benefits, like the CCB, are typically adjusted annually in July based on inflation. Provincial benefits have their own review schedules.

Enter your email below to receive our exclusive PDF guide: "Government Benefits in Canada: What You Might Be Eligible For in 2025." Stay informed and maximize your financial support.